About a third of Bitcoin (BTC) mining firms may already be switching off their machines as the business becomes unprofitable due to a reduction in mining rewards.

The third Bitcoin halving – consummated earlier today – reduced supply of the pioneering cryptocurrency, cutting the bonus paid to miners for solving mathematical puzzles that underpin the network by 50% to 6.25BTC per block.

According to Alejandro De La Torre, VP at mining pool Poolin, miners who make up between 15% to 30% of the entire BTC network hashrate are already in the process of shutting down as profit margins come under pressure.

Those companies operating inefficient “old generation” mining rigs, such as Bitmain’s S9 miner, on higher electricity costs, will be most affected, he opined.

“The … final difficulty adjustment with the 12.5 BTC block subsidy will occur one week before the halving (1008 blocks), and the difficulty is projected to increase,” De La Torre wrote in a recent analysis, adding:

We expect that the first 1008 blocks after the halving will be mined slowly as huge numbers of unprofitable miners drop off the network. We estimate around 30% of the entire Bitcoin network will be squeezed considering that the first 1008 blocks will have the pre-halving difficulty, but half the reward.

Miners are facing pressure from the periodic halving, as the event will affect revenues for mining companies a great deal.

Some experts argue that the revenue decline might be compensated by a spike in the price of BTC – a feat generally associated with previous halving events. However, if the price drops, less efficient miners will be squeezed out faster.

De La Torre said “mining is a long game about survival” and firms that fail to move to more efficient mining machines or to find cheaper electricity will “capitulate”.

“While we expect most of these miners will shut down after the halving, it is likely that some of them have cheap enough electricity to survive in the near future,” he stated.

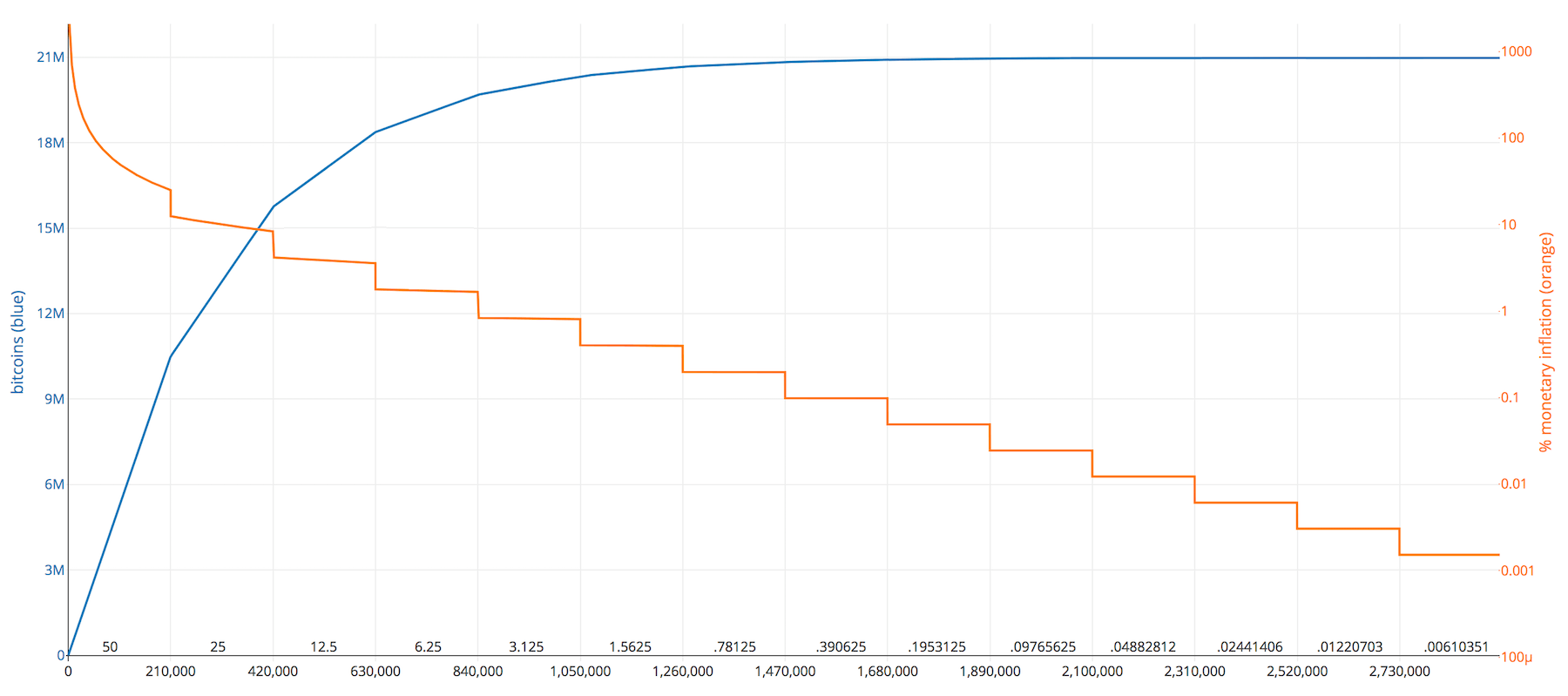

The Bitcoin mining reward has dropped from 50 in 2009 to 25 in 2012; 12.5 in 2016 and then to 6.25 this year (all in BTC), in a pre-determined, inalterable supply cut every fourth year, meant to keep inflation in check

by Jeffrey Gogo