Int the world of traditional finance, certain names are used as references. Paul Tudor Jones is one of those whose opinion counts more than others. Managing currently a hedge fund with nearly 40 billion dollars assets, Paul Tudor Jones became a legend on October 19, 1987.

This day corresponds to Black Monday, during which all the world markets experienced a huge correction. During Black Monday, the Dow Jones lost almost 23%. Hardly anyone had seen such a fall coming. No one except Paul Tudor Jones.

Shortly before the crash, Paul Tudor Jones came to the conclusion that Wall Street was heading straight for the wall. Paul Tudor Jones formed this opinion by conducting a thorough technical analysis of the S&P 500, but also by analyzing the historical data of the index.

In order to take advantage of this, Paul Tudor Jones went massively short U.S. stocks. On Black Monday, Paul Tudor Jones won over $100 million.

Since this episode became legendary, Paul Tudor Jones’ opinions have logically been listened carefully.

In the past, Paul Tudor Jones has never been a Bitcoin fan. Far from being as fierce an opponent as Warren Buffett, he confessed that he did not especially want to position himself on Bitcoin due to his lack of confidence in the queen of cryptocurrencies.

Paul Tudor Jones opts for Bitcoin to hedge against the great monetary inflation

The fact that Paul Tudor Jones wasn’t especially keen on buying Bitcoin in the past makes what happened on May 7, 2020 even more interesting.

In a letter to his investors, Paul Tudor Jones made a statement that had the effect of a small bombshell in the world of traditional finance and the Bitcoin world:

“We are witnessing the Great Monetary Inflation — an unprecedented expansion of every form of money unlike anything the developed world has ever seen. The best profit-maximizing strategy is to own the fastest horse. If I am forced to forecast, my bet is it will be Bitcoin.”

— Paul Tudor Jones

Like many other people interested in the world of finance, Paul Tudor Jones is well aware that the Fed’s current policy of unlimited quantitative easing will lead to unprecedented monetary inflation.

As a hedge fund manager, Paul Tudor Jones’ role is to develop the best possible strategies to maximize his profits.

In this context, pragmatism must prevail over personal opinions. To maximize profits, a hedge fund manager must find the fastest horse in the race.

Paul Tudor Jones’ decision is pure pragmatism

Faced with the rise of a Bitcoin which is the best performing asset of 2020 against gold or Wall Street, Paul Tudor Jones is convinced that Bitcoin is the fastest horse.

It must be said that with a price close to $10,000, Bitcoin is at +38% since the beginning of the year.

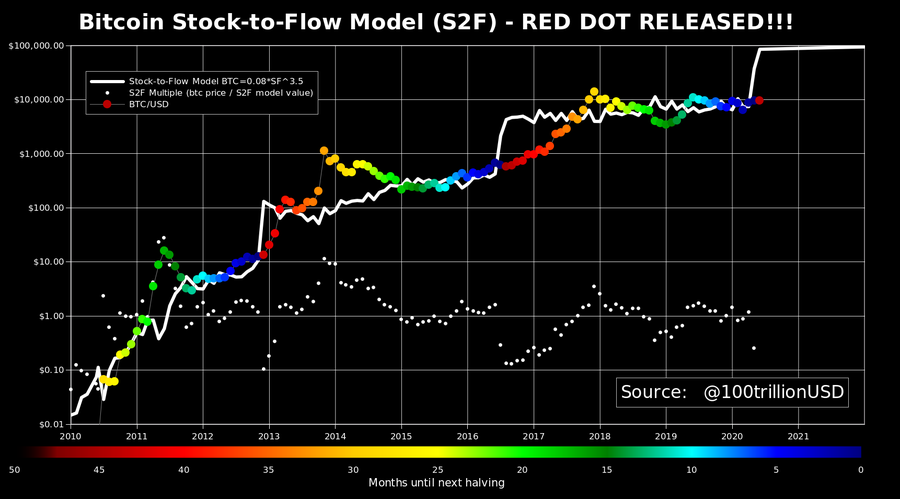

All this while Bitcoin third Halving hasn’t happened yet. And everyone knows that this exceptional event for Bitcoin will cause a very strong bull market in the next 18 to 24 months.

Coupled with the macro economic context made extremely difficult by the coronavirus pandemic, all this leads us to believe that Bitcoin price’s increase will be much more spectacular in the coming months.

Paul Tudor Jones has therefore decided to opt for Bitcoin rather than gold in order to protect himself from the inflation that will take place in the coming months.

His position on Bitcoin was not taken on spot market, but by buying derivatives on Bitcoin Futures.

The rest of Paul Tudor Jones’ letter is also interesting to read, as it confirms that only pragmatism guided his choice :

“I am not a hard-money nor a crypto nut. The most compelling argument for owning Bitcoin is the coming digitization of currency everywhere, accelerated by Covid-19.”

— Paul Tudor Jones

To see such a respected person in the traditional financial world taking a stand for Bitcoin in this way is an extremely bullish signal.

In the coming weeks and months, I am sure that other major hedge fund managers will do the same. This potential entry of large institutional investors into the Bitcoin world is clearly one of the major factors driving Bitcoin beyond the current $10,000 currently.

Bitcoin will replace the role played by gold

The decision taken by Paul Tudor Jones also makes it clear that Bitcoin will increasingly replace gold in the future as a store of value to hedge against currency devaluation.

While Bitcoiners have been certain of Bitcoin’s objective superiority over gold for long time now, Paul Tudor Jones seems to be gradually coming to that conclusion.

In particular, Paul Tudor Jones states that “Bitcoin reminds me of gold when I first got into the business in 1976”.

The simplest way to verify this is to first look at the evolution of the price of gold during the 1970s:

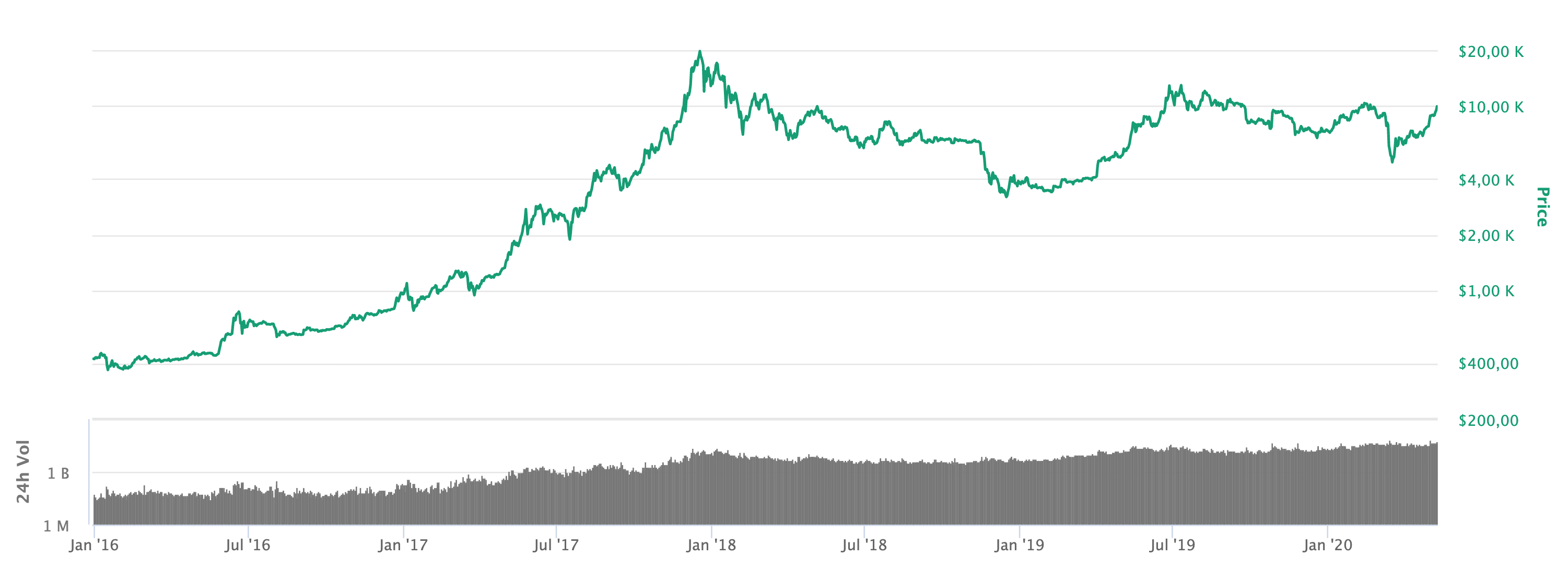

Then we can compare all this with the evolution of Bitcoin price over the last five years:

By using a logarithmic scale on each of the two charts, we can actually better understand why the current situation of Bitcoin price reminds Paul Tudor Jones of the gold situation in 1976.

If the strong bull market expected for Bitcoin in the 18 and 24 months following its third Halving does indeed take place, the trend correspondence between the two charts could be confirmed by the end of 2021.

Should the price of Bitcoin experience this trend in the coming months, Paul Tudor Jones will once again have demonstrated his pragmatism and flair that is unparalleled in the financial world.

Until you can check all this out, the best thing to do is not to lose sight of the fact that Bitcoin is well the fastest horse in the race at the moment. Betting against the fastest horse is never a good idea in the race for profits.